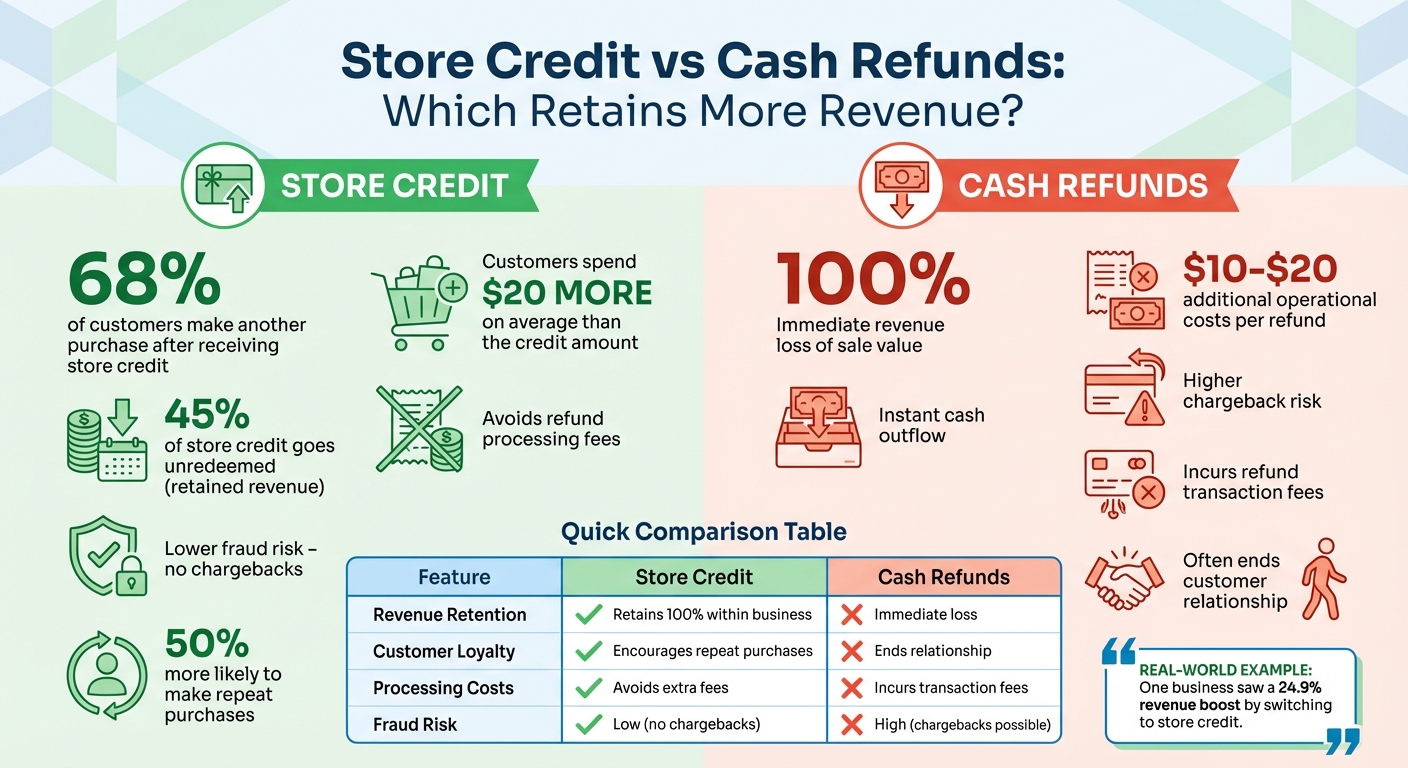

When customers return items, you have two main options: offer a cash refund or store credit. Cash refunds can lead to immediate revenue loss and extra fees, while store credit keeps money within your business and encourages future purchases. Here's why store credit is often the better choice:

- 68% of customers make another purchase after receiving store credit, compared to fewer with cash refunds.

- Customers using store credit spend, on average, $20 more than the credit amount.

- 45% of store credit goes unredeemed, meaning you retain that revenue.

- Store credit reduces refund processing costs and minimizes fraud risks like chargebacks.

By shifting your return policy to prioritize store credit, you can retain revenue, build customer loyalty, and streamline operations. Automated tools, like ForthRoute, make managing store credit simple, offering features like instant credit issuance and reminders to boost redemption rates. Balancing flexibility with clear policies ensures your customers remain satisfied while your business benefits.

Quick Comparison:

| Feature | Store Credit | Cash Refunds |

|---|---|---|

| Revenue Retention | Retains funds within the business | Immediate revenue loss |

| Customer Loyalty | Encourages repeat purchases | Ends the customer relationship |

| Processing Costs | Avoids extra fees | Incurs refund transaction fees |

| Fraud Risk | Low (no chargebacks) | High (chargebacks possible) |

Store credit transforms returns into opportunities for growth, making it a smart choice for businesses focused on long-term success.

Store Credit vs Cash Refunds: Revenue Impact Comparison

How to give Customers store credit for refunds and returns in Shopify - Shopify Mechanics

sbb-itb-a3e286c

How Store Credit and Refunds Affect Revenue and Cash Flow

Store credit helps retain the value of a sale within your business until it's redeemed, while cash refunds create an immediate outflow of funds. Let’s break down how these two approaches impact your business.

When you issue a $100 cash refund, the loss is immediate, and you’re often hit with an extra $10–$20 in operational costs for logistics and labor. On the other hand, offering store credit eliminates these additional refund processing fees and keeps the money on your balance sheet, at least until the credit is used.

Store credit has another advantage: it often goes unredeemed. Nearly 45% of issued store credit remains unused, which means less effort on your part and better cash flow preservation. In contrast, cash refunds instantly reduce your available funds.

Here’s a real-world example: the apparel brand Silk & Salt saw a 24.9% boost in revenue after introducing store credit options. Tools like Forthroute make managing this process even easier by automating returns, converting refund requests into retained revenue, and simplifying store credit management to support ongoing cash flow.

Comparison Table: Store Credit vs. Refunds

| Feature | Store Credit | Cash Refunds |

|---|---|---|

| Revenue Retention | Keeps 100% of funds within the business | Full sale value is lost immediately |

| Immediate Financial Impact | Preserves the sale value | Immediate cash outflow |

| Payment Processing Costs | Avoids additional refund transaction fees | Incurs fees for processing the refund |

| Cash Flow Timing | Cash remains on the balance sheet | Reduces available cash instantly |

| Chargeback Risk | Lower risk of disputed charges | Higher risk of chargebacks |

| Customer Lifetime Value | Can increase through repeat purchases | May decline as the customer relationship ends |

Customer Loyalty and Repeat Purchase Behavior

Store credit doesn't just retain revenue - it strengthens customer loyalty. Return policies play a critical role in shaping long-term relationships. While cash refunds often mark the end of a transaction, offering store credit keeps customers connected to your brand and encourages future purchases.

How Store Credit Drives Repeat Purchases

Store credit transforms returns into opportunities for future sales. In fact, customers who receive store credit are 50% more likely to make another purchase compared to those who get cash refunds. Why? Customers often view store credit as "pre-spent money", which leads to more spontaneous shopping and, frequently, larger purchases. This behavior not only boosts repeat visits but also increases overall spending, further solidifying their loyalty to your brand.

Timing is also key. Around 80% of customers redeem their store credit within the first two weeks, often using it to explore new products. However, redemption rates drop below 10% after a month, making timely follow-ups during this window crucial for maintaining engagement.

"We offer store credit instead of cash refunds for two reasons: first, because it provides our customers with a more convenient and flexible option for future purchases. Second, because store credit incentivizes customers to shop with us again and helps us build long-term relationships with them."

- William McGrath, CEO, Classy Woman Collection

Platforms like Forthroute simplify this process by prioritizing exchanges and store credit in the return workflow. Their AI-driven system suggests alternative products based on the return reason. For example, if a customer returns a shirt for being "too small", the platform can immediately recommend the next size up - converting a potential refund into an exchange.

These strategies highlight how store credit can foster customer loyalty, especially when compared to the effects of traditional refunds.

How Refunds Affect Customer Perception

While store credit encourages ongoing engagement, cash refunds often send the opposite message: the transaction is over. This can impact customer trust and reduce the likelihood of future purchases. Even if the refund process is smooth, it misses the chance to create a positive, ongoing relationship.

Refunds can also leave a lingering impression of dissatisfaction. Considering that acquiring a new customer costs five times more than retaining an existing one, every refund represents a missed opportunity to build loyalty. On the other hand, 95% of customers say they would shop again with a brand after a positive return experience. This makes offering flexible store credit not just a convenience but a smart strategy for long-term growth.

Operational Efficiency and Fraud Prevention

Store credit isn't just about keeping revenue - it’s a game-changer for streamlining operations and minimizing fraud risks. It simplifies processes, preserves cash flow, and maintains customer trust. Traditional refunds often involve payment processors, manual approvals, and waiting for bank transfers, which can drag out the process. Store credit, on the other hand, is quick and handled internally, freeing up your team to focus on growth initiatives. Let’s break down how it reduces manual work and tackles fraud.

Reducing Manual Work With Store Credit

Store credit slashes the time your support team spends managing returns. With returns management systems, credit can be automatically issued as soon as a return is approved. This eliminates the hassle of bank transfers or credit card reversals. Plus, self-service portals empower customers to initiate returns and redeem credit on their own, cutting down on support tickets.

Take this example: A retailer found that converting 20% of potential refunds into gift cards and exchanges streamlined their return process and reduced customer service inquiries. Automated credit issuance not only keeps things running smoothly but also ensures cash flow stays intact.

Platforms like ForthRoute take automation to the next level. With tools like smart automation rules, you can set policies such as "Auto-approve returns under $50" or "Reject items marked Final Sale." These systems handle everything from approval decisions to shipping labels and credit issuance, freeing up your team to focus on more strategic tasks.

Preventing Fraud and Chargebacks

Store credit also acts as a shield against fraud and chargebacks. Unlike cash refunds, which can be exploited, store credit keeps value within your business ecosystem. It discourages practices like wardrobing - where customers buy items for one-time use and return them for cash - since the credit can only be used for future purchases.

Chargebacks, where customers dispute transactions with their banks, are another headache store credit helps avoid. These disputes come with fees and administrative burdens, but by keeping transactions internal, store credit sidesteps these issues entirely. This reduces both fraud risks and processing costs.

Store credit is also flexible enough to handle tricky situations. For example, if a customer returns an item in poor condition, you can issue partial credit instead of denying the return outright. This approach protects your margins while still keeping the customer happy.

Customer Satisfaction and Flexibility

Store credit and refunds each play an important role in keeping customers happy, but they serve different purposes. Refunds act as a safety net, offering the classic money-back guarantee that reassures shoppers before they even make a purchase. On the other hand, store credit transforms a return into an opportunity to keep customers engaged, allowing your business to retain revenue while encouraging future purchases.

When customers can choose how their return is handled, their satisfaction naturally increases. Offering this control not only builds trust but also strengthens relationships. As Joyeeta Ghosal puts it:

"Store credit isn't just about quick fixes; it's about building lasting relationships".

This flexibility allows businesses to create return policies that protect revenue while empowering customers to make the choices that work best for them.

Balancing Store Policies With Customer Preferences

Flexible return options are key to aligning store policies with what customers want. By offering choices, businesses can support smooth operations while fostering loyalty over the long term.

One effective strategy is to make store credit more appealing without forcing it as the only option. For example, providing a bonus - like an additional 10% in value - when customers opt for store credit instead of a refund can make them feel rewarded rather than confined. Carly Greenberg explains this approach well:

"By offering your shopper access to a store credit bonus... you're likely to incentivize them to take another look at your store and choose a new item".

Self-service portals can take this flexibility a step further by giving customers full control over their return process. Tools like ForthRoute allow shoppers to instantly see their options - refund, exchange, or store credit - without needing to wait for customer support. These portals can also highlight the advantages of store credit while ensuring refunds remain available for situations like defective products. Interestingly, 80% of customers redeem their store credit within the first two weeks, making automated reminders a powerful way to encourage timely use.

Best Practices for Implementing Store Credit

Automation and Clear Policy Communication

Introducing store credit doesn't have to overwhelm your support team with manual tasks. Automation can handle everything - from issuing credit codes to tracking balances and sending reminders. This frees your team to focus on bigger-picture goals while making the process seamless for customers. For instance, you can automatically add bonus incentives (like an extra 10% value) when customers opt for store credit instead of cash refunds, encouraging them to choose options that retain revenue.

Platforms like ForthRoute simplify the process even further. Instead of relying on lengthy email exchanges, customers can use a self-service portal to select store credit, exchanges, or refunds in just a few clicks. These systems automatically apply incentives, making the experience both efficient and appealing, keeping customers connected to your brand.

Clear communication is just as important as automation. Make sure your store credit policies are easy to find on your website. Include details like expiration dates, restrictions on combining credits with promotions, and simple instructions for checking balances. You can also guide customers toward retention-friendly options by placing buttons like "Find the Right Fit" or "Exchange Instantly" prominently in your returns portal - ideally before they even see the refund option.

"Offering incentives for customers who choose store credit, such as bonus points or discounts on future purchases, is a great way to gently guide your customers toward store credit options" - William McGrath, CEO, Classy Woman Collection

Once these automated systems are in place, keeping track of their performance is key to unlocking their full potential.

Tracking and Optimizing Store Credit Usage

With automation handling the groundwork, tracking how store credit is used helps ensure your strategy drives revenue growth. The first two weeks after issuing credit are critical - this is when customers are most likely to redeem it. Automated reminders during this window can help capture their attention and boost engagement.

Keep an eye on important metrics like redemption rates, average order value during redemptions, and the percentage of customers choosing credit over refunds. For example, in March 2025, apparel brand Silk & Salt saw a 24.9% revenue boost after rolling out a store credit program. Customers added an average of $20 to their orders when redeeming credit, creating an upsell effect. Interestingly, 90% of customers used a credit card to cover additional charges like shipping, taxes, or upgrades when redeeming their store credit.

Use your returns management system to schedule automated email or SMS nudges during the early redemption period. Additionally, analyze exchange trends to fine-tune your instant exchange recommendations, ensuring they align with customer preferences and drive even better results.

Conclusion

Comparing store credit to cash refunds shows clear benefits for businesses, especially in terms of keeping revenue, strengthening customer loyalty, and streamlining operations.

Opting for store credit helps retain revenue and promotes long-term growth. The data is compelling: 68% of customers make repeat purchases after receiving store credit, and they typically spend $20 more per order when using it. This approach safeguards income that would otherwise be lost through traditional refunds.

Store credit also strengthens customer relationships by encouraging shoppers to return. What could be a negative experience is transformed into a chance for continued engagement. Plus, automated systems make the process seamless - credit is issued instantly, reminders are sent, and balances are tracked, freeing up your support team for more pressing tasks.

To maximize the impact of store credit, make it simple and appealing for customers to choose. Structure your returns process to highlight exchanges and store credit options before offering refunds. Sweeten the deal with bonus credit to nudge customers toward retention-focused choices. Using tools that automate everything - from approval rules to redemption reminders - can make this process even smoother.

ForthRoute offers an easy solution with a self-service portal that encourages exchanges and store credit while automating tasks like approval rules and shipping labels. At just $19/month with a 14-day free trial, it’s a practical tool for Shopify merchants looking to hold onto more revenue without adding extra work. With the right system, returns can become a springboard for future sales instead of a drain on profits.

FAQs

How does offering store credit build customer loyalty compared to giving refunds?

Store credit is a smart way to boost customer loyalty while keeping money circulating within your business. When shoppers receive store credit, they’re more inclined to return and make additional purchases, building an ongoing connection with your brand.

What’s more, store credit often leads to increased spending. Customers frequently buy items that exceed their credited amount, which benefits your bottom line. Unlike cash refunds that take money out of your business, store credit encourages repeat visits and enhances customer lifetime value. It’s not just about retaining revenue - it’s about creating stronger, lasting relationships with your customers.

What are the advantages of offering store credit instead of cash refunds?

Opting for store credit instead of cash refunds can bring some clear benefits to your business. For starters, it helps you keep revenue within your company by encouraging customers to shop with you again instead of taking their money elsewhere. This not only boosts cash flow but also increases the chances of repeat purchases, which can strengthen customer loyalty over time.

On top of that, using tools like Forthroute's self-service portal to automate store credit issuance makes the returns process easier for everyone. It cuts down on the manual work your support team has to handle, lowers operational costs, and creates a hassle-free experience for your customers. By keeping funds in-house and promoting future purchases, store credit can lead to better customer retention, higher lifetime value, and a more streamlined way to manage returns.

How can businesses encourage customers to choose store credit over cash refunds?

Businesses can make store credit an appealing option by highlighting its perks, like added shopping flexibility and access to exclusive benefits. Unlike refunds, store credit keeps the money circulating within the business, encouraging customers to return and shop again - boosting their overall lifetime value.

To sweeten the deal, businesses can offer rewards for selecting store credit. For example, customers might receive discounts or special access to limited-time offers. By clearly explaining these benefits during the returns process, businesses can position store credit as the go-to choice, retaining more revenue while strengthening customer loyalty.